Setting up a budget is one way to grow wealth. Budgeting helps us track our expenses so that we know where our money is going. Some of our expenses are legitimate – the mortgage, utilities, insurance, groceries, fuel, etc. When we take the time to investigate our spending habits, we usually find that we spend more money than we thought on frivolous items.

Setting up a budget is one way to grow wealth. Budgeting helps us track our expenses so that we know where our money is going. Some of our expenses are legitimate – the mortgage, utilities, insurance, groceries, fuel, etc. When we take the time to investigate our spending habits, we usually find that we spend more money than we thought on frivolous items.

I am not saying that we can’t have fun money in the budget. I am saying that if we are smart, we have money for fun but plenty of money in our savings accounts. Hopefully we have more than one savings account. I would have an emergency fund, a retirement fund, a vacation fund, and a mad money fund for everything frivolous that we must have to stay motivated and keep up the hard work. The mad money fund can also be in cash so that when it is gone, that is it until the next funding cycle.

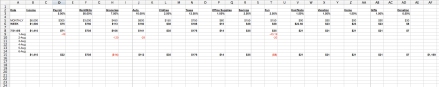

(Click the image to view it larger)

(Click the image to view it larger)

To set up the initial budget, we have to track the expenses. Set up a few columns for income and the necessary expense categories. If you are on a fixed income, you know what you are making each month. Write the income in one column. If you are self-employed, you can do an average of the last 6 months or write in the amount that you know you must make each month to live. On the high months, put the extra money away for the low months so that in the low months, your budget is not short.

If you use a software program, like Quickbooks, Mint.com, or Excel, run the P&L report by month to total the expenses and recurring debit categories. If you do not use software for tracking, get your last 3 bank statements and a highlighter and start marking it up. Then use a calculator to total up each category.

If you use a software program, like Quickbooks, Mint.com, or Excel, run the P&L report by month to total the expenses and recurring debit categories. If you do not use software for tracking, get your last 3 bank statements and a highlighter and start marking it up. Then use a calculator to total up each category.

This will need to be done on the business level as well if you are self-employed.

One major category to watch is the Misc/Fun category. This column is for all unnecessary expenses like dinner out, clothes, movies, Starbucks, etc. Again, I am not saying that we should not have fun in our budget, at this point we are narrowing down our essential living expenses so that we can make room for everything else. There is usually a lot of money floating in this category that could be better used in the emergency fund or the retirement fund.

Once you have your numbers, review them and see where you can improve or save. If you aren’t bringing in enough money to cover your basic living expenses, then your Misc/Fun category should be near zero until you find work that pays better.

A few simple improvements can sometimes make all the difference between overspending and saving. If the grocery category seems high, use coupons. If your Misc/Fun category seems high, take advantage of Groupons and online coupons to cut these costs in 1/2.! If your cell phone, cable or health insurance costs seem high, make a phone call and see if your provider can do better. There are plenty of discounts offered to new customers that existing customers can take advantage of as well if we ask.

We need to live our budget today, review our habits weekly and revisit the budget every quarter for necessary fine tuning. Budgeting and tracking today will set up our future. When we have money to live, invest, and play, we are on the right path. In the beginning days of budgeting or if our income isn’t where it should be, we need to be very vigilant with our money. When we have put in the time, the budget will improve and we can ease up a bit and not have our budget be overwhelmed by a $4.00 coffee or a $20 pair of shoes! Let the budget work for you to eliminate the stress of overdraft fees for good. You will also find that you eliminate debt and improve your credit score for even more savings!

I am here to help and answer any questions that you have. You can subscribe to my blog for future information or send me a message on my Facebook page at http://Facebook.com/ProjectDone which I will gladly answer.