I’ve reposted an article from Jim Rohn before, and after reading this one, I knew I had to share it with you, too! He has such a great outlook on success and what motivates and inspires me. Every week I receive his email newsletters and I am always excited to see what he has to say next. Get your own subscription here! (Also, for more great tips, like him on Facebook)

Personal Development – The Plan by Jim Rohn

Now, here is my definition of success: A few simple Disciplines practiced every day. Do you see the distinction? A few disciplines… Here’s a little phrase we’ve all heard, “An apple a day keeps the doctor away.” And my question to you is, “What if that’s true?” How simple and easy is that plan?

Now, here is my definition of success: A few simple Disciplines practiced every day. Do you see the distinction? A few disciplines… Here’s a little phrase we’ve all heard, “An apple a day keeps the doctor away.” And my question to you is, “What if that’s true?” How simple and easy is that plan?

The fact is, when you look at successful people, you will almost always discover a plan behind their success. They know what they want, they work out a plan that will get them where they want to go, and they work their plan. It is the foundation for success. We as humans have the unique ability to affect change in our lives; it is through our own conscious choice when we engage in the miracle process of personal development that we are able to transform our nature and our lives.

It is the combination of the materials and your open attitude towards learning, driven by the diligent following of a plan that is right for you, that will make this year the kind of success you want it to be. So let me challenge you to be no less sincere, be no less committed to the advancement of your philosophy, the set of your sail, your plan.

So, what are some good ideas on developing a plan that will work well and take you to the finish line powerfully and in style? Here are some major points to keep in mind:

Develop the Plan for You. Some people are very detail oriented and they will be able to follow an intricate plan closely. Others are a little more “free-wheeling” and not really “detail” people. That is okay too. In all the years of my speaking to audiences worldwide, people have asked the question, “What plan is the right plan?” And my answer, the plan that fits you. Your plan, the one you develop that is unique to you and for you. You see, each of us is unique and motivated by different factors and you’ve got to develop one that is right for you and fits you. Some plans will not be as intricate as others but we all must have a plan, along with goals in that plan, to move us along the program. If you are a free spirit type, don’t tell yourself you are going to spend 2 hours a day with a book and tapes and journal. It probably won’t happen and you will get discouraged! Whatever your personality, your strengths and your weaknesses, develop the plan around them! This is not a one-plan-fits-all proposition.

Establish Times to Spend Working on the Material. It may be every Sunday night. It may be 20 minutes each morning. It may be in the car listening to the CD’s every Monday, Wednesday, and Friday. Whatever it is, set the times and do it. In your step-by-step plan, put down points that you can accomplish every week. They should be specific and achievable. Develop the discipline and take those steps every day, which will move you closer to your goals and where you want to be.

Keep a Journal. Take notes. It may be on paper, it may be on a micro-recorder. Mr. Schoaff taught me not to trust my memory, but to write it down, to find one place to gather the information that affects change. And that advice has served me well all these years. Record the ideas and inspiration that will carry you from where you are to where you want to be. Take notes on the ideas that impact you most. Put down your thoughts and ideas. Brainstorm with yourself on where you are going and what you want to do. Record your dreams and ambitions. Your journals are a gathering place for all the valuable information that you will find. If you are serious about becoming wealthy, powerful, sophisticated, healthy, influential, cultured, unique, if you come across something important write it down. Two people will listen to the same material and different ideas will come to each one. Use the information you gather and record it for further reflection, for future debate and for weighing the value that it is to you.

Reflect. Create time for reflection — a time to go back over, to study again the things you’ve learned and the things you’ve done each day. I call it “running the tapes again” so that the day locks firmly in your memory so that it serves as a tool. As you go through the material in this plan, you will want to spend time reflecting on its significance for you. Regularly set aside time – here are some good guidelines for times to reflect: At the end of the day. Take a few minutes at the end of each day and go back over the day – who’d you talk to, who’d you see, what did they say, what happened and how’d you feel, what went on. A day is the piece of the mosaic of your life. Next, take a few hours at the end of the week to reflect on the week’s activities – I would suggest at least one half-hour. Also during that weekly time, take a few minutes to reflect on how this material should be applied to your life and circumstances. Take a half day at the end of the month and a weekend at the end of the year so that you’ve got it so that it never disappears, to ensure that the past is even more valuable and will serve your future well.

Set Goals. While we are going to cover this soon enough in upcoming weeks, let’s just remember that your plan is the roadmap for how you are going to get to your goals, so you have to have them. Of all the things that changed my life for the better (and most quickly), it was learning how to set goals. Mastering this unique process can have a powerful effect on your life too. I remember shortly after I met Mr. Shoaff, he asked me if I had a list of my goals, and of course I didn’t. He suggested to me that because I lacked a set of clearly defined goals that he could guess my bank balance within a few hundred dollars… and he did! Well, Mr. Shoaff immediately began helping me define my view of the future, my dreams. He taught me to set goals because it is the greatest influence on a person’s future and the greatest force that will pull a person in the direction that they want to go. But the future must be planned, well designed to exert a force that pulls you towards the promise of what can be.

Act. Act on your plan. What separates the successful from the unsuccessful so many times is that the successful simply do it. They take action, they aren’t necessarily smarter than others; they just work the plan. And the time to act is when the emotion is strong. Because if you don’t, here’s what happens – it’s called the law of diminishing intent. We intend to act when the idea strikes us, when the emotion is high, but if we delay and we don’t translate that into action fairly soon, the intention starts to diminish, diminish and a month from now it’s cold and a year from now it can’t be found. So set up the discipline when the idea is strong, clear and powerful – that’s the time to work the plan. Otherwise the emotion is wasted unless you capture the emotion and put it into disciplined activities and translate it into equity. And here’s what is interesting: all disciplines affect each other; everything affects everything. That’s why the smallest action is important — because the value and benefits that you receive from that one little action will inspire you to do the next one and the next one… So step out and take action on your plan because if the plan is good, then the results can be miraculous.

We are at the beginning of a fantastic journey that is going to help us become all that we want to – so let’s get going!

Setting up a budget is one way to grow wealth. Budgeting helps us track our expenses so that we know where our money is going. Some of our expenses are legitimate – the mortgage, utilities, insurance, groceries, fuel, etc. When we take the time to investigate our spending habits, we usually find that we spend more money than we thought on frivolous items.

Setting up a budget is one way to grow wealth. Budgeting helps us track our expenses so that we know where our money is going. Some of our expenses are legitimate – the mortgage, utilities, insurance, groceries, fuel, etc. When we take the time to investigate our spending habits, we usually find that we spend more money than we thought on frivolous items.

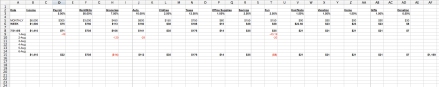

If you use a software program, like Quickbooks, Mint.com, or Excel, run the P&L report by month to total the expenses and recurring debit categories. If you do not use software for tracking, get your last 3 bank statements and a highlighter and start marking it up. Then use a calculator to total up each category.

If you use a software program, like Quickbooks, Mint.com, or Excel, run the P&L report by month to total the expenses and recurring debit categories. If you do not use software for tracking, get your last 3 bank statements and a highlighter and start marking it up. Then use a calculator to total up each category.

We can get a free annual credit report from all three credit bureaus at:

We can get a free annual credit report from all three credit bureaus at:

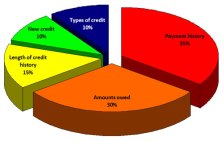

April was Financial Literacy Month. Financial service companies feel that Americans are financial illiterates who do not pay attention to the detail or the fine print. As financially literate people, we need to understand how we use our money when saving, spending and investing. It is expensive to ignore the lessons and it is time that we take action to better understand our financial future. The more we know, the better protected we will be.

April was Financial Literacy Month. Financial service companies feel that Americans are financial illiterates who do not pay attention to the detail or the fine print. As financially literate people, we need to understand how we use our money when saving, spending and investing. It is expensive to ignore the lessons and it is time that we take action to better understand our financial future. The more we know, the better protected we will be.

6. Learn about your insurance policies. Are you really insured with the best company? Do you have an agent that is available to answer your questions? If you didn’t answer yes to these questions, it might be time to do a little shopping. Know what your current coverage is and see if you can do better. Ask friends for referrals and interview at least 3 companies to see if you can get better coverage at a better rate.

6. Learn about your insurance policies. Are you really insured with the best company? Do you have an agent that is available to answer your questions? If you didn’t answer yes to these questions, it might be time to do a little shopping. Know what your current coverage is and see if you can do better. Ask friends for referrals and interview at least 3 companies to see if you can get better coverage at a better rate.

That would be worse case scenario but having a plan and the knowledge that comes with a budget, would go a long way towards your family’s security. If you like being in the dark because the idea of knowing how much money is going out vs. coming in, you are not alone. The budget can be a scary and daunting task. Why not get involved now to gain the knowledge that you need to protect your future.

That would be worse case scenario but having a plan and the knowledge that comes with a budget, would go a long way towards your family’s security. If you like being in the dark because the idea of knowing how much money is going out vs. coming in, you are not alone. The budget can be a scary and daunting task. Why not get involved now to gain the knowledge that you need to protect your future.